What are Capital Credits?

Your cooperative is operated on a not-for-profit basis. As a member of Central Wisconsin Electric Cooperative you share in any excess margins (revenues - expenses) the Co-op has in a particular year. The surplus margins are allocated to members of the cooperative in the form of Capital Credits. Quite simply put, Capital Credits reflect each member's ownership in the cooperative. Capital Credits are used by your cooperative to help build and maintain the electric system and then when finances permit, the board of directors authorize a cash refund to you.

UNCLAIMED PATRONAGE CAPITAL CREDITS

Central Wisconsin Electric Cooperative has unclaimed patronage capital funds for former members of Central Wisconsin Electric Cooperative.

Funds for these people have been unclaimed for three years. In accordance with Cooperative bylaws, after 60 days from this publication, the unclaimed funds shall be forfeited from the Cooperative to be used for educational loans, scholarships, or charitable purposes.

If you know the whereabouts of these former members, please ask either the individual member or the estate executor to contact us at 800-377-2932. When writing to us, please include information to verify the person is the same one we are trying to locate. A previous mailing address, service address, street, road, or fire number where service was received would be helpful.

Regular business hours are from 7:30 a.m. – 4 p.m., Monday – Friday. If you prefer e-mail, address your message to cwec@cwecoop.com

We respond to all inquiries, however, due to the large volume of inquiries please be patient as we do our best to serve you, our Member.

CO-OP RETIRES $300,000 IN CAPITAL CREDITS

One of the benefits of being a member of Central Wisconsin Electric Cooperative (CWEC) is that members are eligible to receive capital credits. Capital credits represent your ownership in CWEC. Each October CWEC returns to its members a portion of their capital credits.

Unlike investor-owned utilities who maximize profits to pay dividends to shareholders, CWEC, which is a not-for-profit electric cooperative, provides its members with “at cost” electric service. We do not exist to earn a profit.

When each year’s finances are audited and closed out, the remaining profit or margins are allocated to the members based on the amount each member paid for electricity during the year in the form of capital credits.

Capital credits are the revenues that remain at the end of the year once all expenses are paid. These revenues, or margins, are then assigned to members based on the amount of energy they consumed during the year.

These capital credits are used by the co-op to help build and maintain the CWEC electric system. When the co-op’s finances permit, the CWEC Board of Directors approves a portion of the allocated capital credits to be retired and pay them back to you – the members.

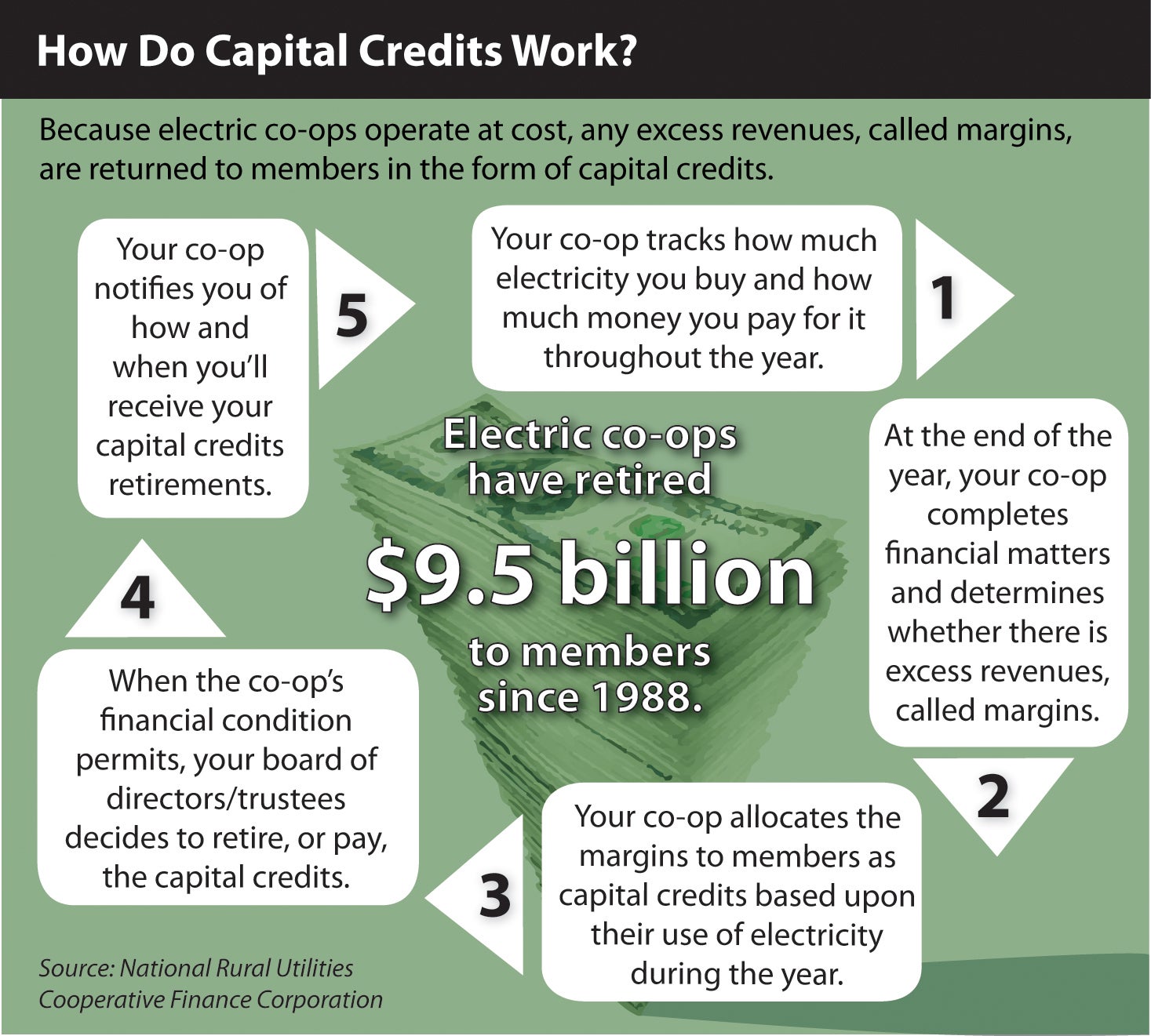

This is how it works:

- CWEC tracks how much electricity you buy and how much money you pay for it throughout the year.

- At the end of the year, CWEC completes financial matters and determines whether there are excess revenues, called margins.

- CWEC allocates the margins to members as capital credits based upon their use of electricity during the year.

- When CWEC’s financial condition permits, the CWEC Board of Directors decides to retire, or pay, the capital credits.

- CWEC notifies you of how and when you’ll receive your capital credits retirements.

This year, the board of directors approved the retirement of $300,000 in capital credits. The retirement will involve capital credits from the 2019 allocations and prior.

Active members whose retired capital credits were less than $100 will receive a credit on their September electric bill, which is mailed to members in October. Checks will be mailed in October to active members whose retired capital credits amounted to more than $100. Checks, with a minimum of $10, were also mailed to all offline members who received retired capital credits.

For more information about capital credits, or to resolve a capital credit account issue, please call our office at 715-677-2211, or send an email to cwec@cwecoop.com.

It’s just another way the cooperative adds value back to our members.

EARLY RETIREMENT OF CAPITAL CREDITS TO ESTATES

In the event that a Central Wisconsin Electric Cooperative (CWEC) member dies, the capital credits in the member’s account become a part of the estate. Up until now, the member’s heirs received the retired capital credits on the deceased’s account on the same schedule established by CWEC for its members.

The CWEC Board of Directors recently changed this policy, and is allowing for the early retirement of capital credits for the outstanding balance of a deceased member’s capital credit account. If early retirement of capital credits is approved, the book value of the capital credits allocated to the deceased member would be discounted to net present value using a discount rate based on the co-ops weighted average cost of capital. The capital credits are discounted in order to balance the fairness between the estates and the other members of the cooperative, recognizing the time value of money (funds received today are worth more than funds received some time in the future).

The change was made to assist the member’s heirs in closing the estate, as well as to provide a fair and equitable method for early retirement of capital credits for estates, heirs, and surviving spouses of deceased members.

The early retirement and disbursement of capital credits to the appropriate estate representatives, heirs, or surviving spouses will be determined on a case-by-case basis by CWEC.

For surviving spouses or other joint members with rights of survivorship, upon the death of one joint member, the surviving joint member will automatically become the sole owner of all capital credits allocated to the joint membership. In this case, the surviving joint member can elect the early retirement of one-half of the capital credits allocated to the joint membership.

Surviving joint members must furnish CWEC a certified copy of the death certificate of the deceased joint member before CWEC will consider assignment or early retirement of the decedent’s percentage share of capital credits.

For one-person memberships, the assignment or early retirement of a deceased member’s capital credits shall only be made at the request of parties who are legally authorized to receive capitals credits. In addition to a certified copy of the death certificate of the deceased member, different forms need to be completed depending if it is an open probate estate, no probate estate, or closed estate. In this case, we ask that you call the CWEC office at 715-677-2211 to obtain the proper forms for your situation.

Any questions can be directed to the CWEC office at 715-677-2211.

CWEC Board Policy No. 408 - Retirement of Capital Credits for Deceased Patrons

Application by Legal Representative of Estate for Redemption of Patronage Capital (Exhibit A)

Application Requesting Redemption of Patronage Capital Closed Estate (Exhibit C)